This article, last updated in December 2023, is original content written by Manchester, CT Financial Advisor Thomas Scanlon, CFP®, CPA.

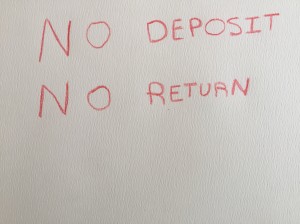

What does this mean? If you don’t put something in (deposit) you won’t get something out (return). Isn’t that the truth? This applies whether you want to learn to play the guitar, improve your culinary skills or learn how to speak German. Sports metaphors are an easy analogy. If the player doesn’t put the time into practice, he won’t be ready on game day. I’m sure you’ve heard the expression… No pain, No Gain.

Financial Deposits

No deposit—no return clearly applies to your financial planning. If you don’t make deposits into savings, 401(k) plans and IRA’s, there will be no return. Folks like this will likely need to continue working. They will likely need to continue to work for a very long period of time…like forever. Saving and investing (or not) is a habit. Naturally, you are better served to start this habit when you are younger. Either way—start now. The importance of financial deposits and investing can’t be overstated. Why is this? You are on your own!

All you need to know is that this is not your parents (or grandparents) retirement. They typically had the trifecta of retirement planning.

First, many investors had a pension plan they could count on when they retired. This was their reward for many years of service with their employer. Second, they had their social security benefit. Lastly, they had their savings. Many commentators have referred to this as the “Three Legged Stool” of retirement.

There is one big leg in the “Three Legged Stool” that seems to be broken. Currently only a small minority of people will be eligible for a pension. These tend to be primarily federal, state, and municipal employees. Most companies have terminated their pension plan and implemented a 401(k) plan. This has shifted the funding and management of the investments primarily from the employer to the employee. So, if you don’t have a pension plan, what do you have? Sure you can collect your social security benefit when you are eligible. But after that it’s only whatever savings and investing plan you can put together.

Do you want to make this plan a little easier? Set this up for automatic savings. Contributions to your 401(k) plan are deducted out of your paycheck and invested automatically. You can do the same thing with your IRA and/or Roth IRA.

In 2023 taxpayers under age 50 can contribute up to $22,500 annually into their 401(k) plan. The federal government actually realizes many folks are way behind in saving for their retirement. For taxpayers over age 50, they can contribute an additional $7,500 in so-called “catch-up” contributions for a total of $30,000. There is also a modest “catch-up” contribution for IRA’s and Roth IRA’s. For taxpayers under the age of 50, they can contribute up to $6,500. For taxpayers over age 50, they can contribute an additional $1,000 for a total of $7,500.

Another place where deposits will need to be made is a college fund. The increase in college tuition has been crazy in the past decade. There does not appear to be any letup in sight. According to the US News (2), the cost for an out-of-state student attending a public school in 2023-2024 was approximately $30,000. The cost of attending a private school was approximately $42,162.

Financial Returns

Making these financial deposits should result in a financial return. The more deposits you make, the lower rate of return you will need to achieve your goal.

Absent inheriting assets or gambling (which I don’t recommend), most people will earn their income by working. This is when you’re working for the money. When you save and invest this gets flipped upside down. Now the money is working for you. Don’t you like this better?

While income is nice, assets will provide the foundation for a comfortable retirement. According to Bankrate.com, the average 401(k) plan had a balance of $129,157 at the end of 2022 (1). While averages can be deceiving, it’s difficult to see how most investors could retire on this account and their social security benefit, particularly here in New England.

One investment vehicle that does not get enough use is the Roth IRA. Why is this? Because there is no income tax deduction up front like there is with a traditional IRA. With an IRA, you get a tax deduction when you make the contribution. Then the account grows tax-deferred. When you begin to take the money out, it is taxed as ordinary income. With the Roth IRA there is no income tax deduction when the contribution is made. The funds are contributed after tax. The real benefit of the Roth IRA is when distributions are made. If the Roth IRA has been open for at least five years and you are over age 59½, all of the distributions are tax-free. Not tax-deferred…tax-free.

Additionally, the Roth IRA is not subject to the Required Minimum Distribution (“RMD”) rules like IRA’s are during the owner’s and surviving spouse’s lifetime. These rules require that investors start to take distributions from their IRA’s when they turn 72. Talk about a financial return.

Younger employees should inquire with their employer if they offer a Roth 401(k) plan. The annual contribution limits are the same for the 401(k) plan mentioned earlier. This is the maximum that can be put into the 401(k) plan, Roth 410(k) plan, or some combination of the two. Unlike the traditional 401(k) plan, employee contributions into a Roth 401(k) plan do not go into the plan pre-tax. Contributions into a Roth 401(k) plan go in after-tax. The income taxes are paid up front. However, when distributions are made from the employee’s contributions they are income tax-free. This is a huge advantage for a younger employee. A younger employee will likely have a more modest salary and therefore a more modest tax bracket. Paying the income tax up front and having these funds grow tax-free for several decades is huge. If the employer is making an employer match, this will need to be done like the traditional 401(k) plan. When distributions of the employer match are made, these will remain taxable as ordinary income.

Intangible Returns

It’s not just the financial returns. It’s also about financial well-being. This can’t always be measured by the size of your portfolio. This is measured more broadly by having a financial plan and sticking with it.

Conclusion

No deposit—No return. If you don’t put something in, you can’t get something out. While you are working, always keep putting something in. This will allow you to start taking something out when you get to retirement. If you need any help with your “No Deposit—No Return”, please give me a call at (860) 645-1515 or email Thomas.Scanlon@raymondjames.com

Thanks for your referrals!

———————————————————————–

(1) nerdwallet.com

(2) usnews.com

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be a reliable, but we do not guarantee that the foregoing material is accurate or complete, and does not constitute as a recommendation. Any opinions are those of Thomas Scanlon, and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

401(k) plans are long-term retirement savings vehicles. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 ½, may be subject to a 10 percent federal tax penalty.

Contributions to a traditional IRA may be tax-deductible depending on the taxpayer’s income, tax-filing status, and other factors.

Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 ½, may be subject to a 10 percent tax penalty.

Like Traditional IRAs, contribution limits apply to Roth IRAs. In addition, with a Roth IRA, your allowable contribution may be reduced or eliminated if your annual income exceeds certain limits.

RMD’s are generally subject to federal income tax and may be subject to state taxes. Consult with your tax advisor to assess your situation. Any matching contribution from your employer may be subject to a vesting schedule. Please consult with your financial advisor for more information.